Econbrowser, 14/05/2020 - Auteurs: Laurent Ferrara et Capucine Nobletz

In this post we assess contagion among government bond markets by focusing on the Covid-19 crisis period. Using the approach put forward by Diebold and Yilmaz (2014), we empirically show that the connectedness dramatically increased on international bond markets over the crisis period. More specifically, this global shock seems to discriminate between safe and risky countries, those latter seeing a large increase in sovereign spreads.

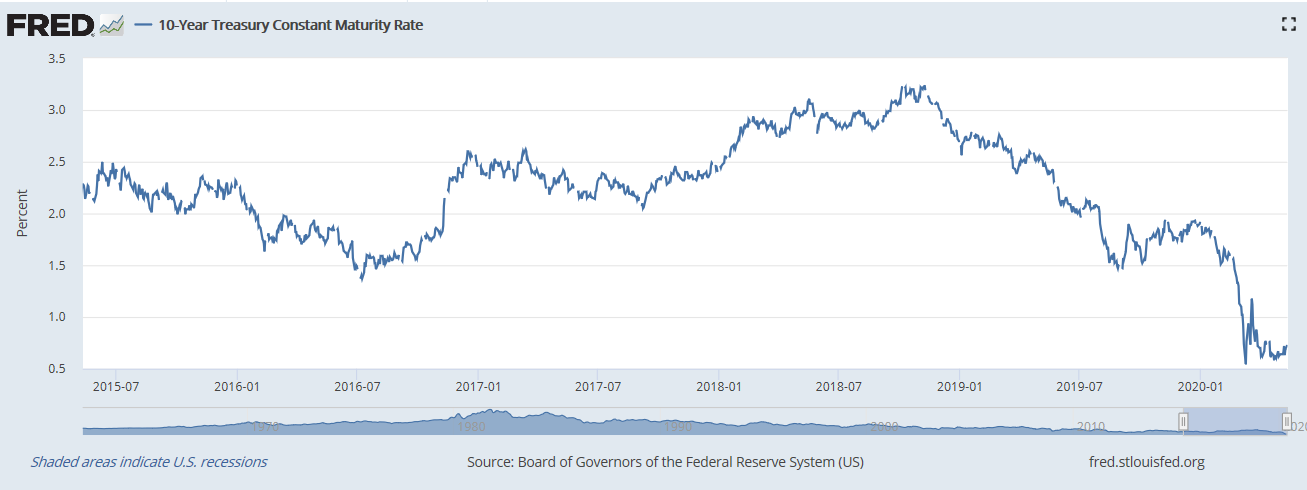

The Covid-19 global crisis generated a worldwide recession (see previous Econbrowser posts here, here and here), as well as abrupt movements on financial markets. For example, oil prices sharply dropped so that price of the May crude-oil futures contract closed on April 20 at negative $37.63 a barrel (see this Econbrowser post here). On the bond market, the 10-year US government bond yield went down from a level close to 2% end of December 2019 to levels between 0.6%-0.7%, in a flight-to-quality move (see Figure 1).

Figure 1. 10-year US government bond yield

Source: Fred database Federal Reserve Bank of St Louis. Last point May 11, 2020.

How to assess contagion dynamics on the global bond market?

In order to assess contagion on the global sovereign bond market, let’s consider daily 10-year government bond returns denominated in local currencies for a bunch of industrialized and emerging countries. The countries selected are: Brazil, China, South Africa for emerging economies and the United Kingdom (UK), the United States (USA) and Germany for advanced economies. The study period runs from January 03, 2006, to April 13, 2020, and all data are extracted from Thomson Reuters Datastream. To obtain time series with the same integration order, we use bond returns and not yields.

The methodology that we use to compute contagion within this system is the one developed by Diebold and Yilmaz in a series of papers in order to compute connectedness indexes. To this aim, we estimate a VAR (Vectorial AutoRegressive) model and compute the generalized forecast error variance. By decomposing this forecast error variance, we identify for each country the share of variance attributable to the different countries in the system. The “own variance share” is the share of variance due to the country itself (thus measuring the openness of the country). The “cross variance share” or “pairwise spillover” is the share of variance of a given country only due to other countries. Once the covariance matrix is computed, we can measure the total spillover index (‘TSI’), measuring the global connectedness of the system. In addition, we can measure the directional and the net spillover indexes. The directional spillovers are the government yield spillovers transmitted by a country to all other markets (‘TO’) and the government yield spillovers received by a country from all other markets (‘FROM’). The net spillover from a given country to others consists in the difference between the share of variance given to others (‘TO’) and the share of variance received from others (‘FROM’)...

Please wait ...

Please wait ...